|

Calculator Library |

|

|||

| Home » 87 Calculators » Blog » How To Use A Calculator For Budgeting And Personal Finance | |||||

HOW TO USE A CALCULATOR FOR BUDGETING AND PERSONAL FINANCE

Click here to try our free online Finance Calculators. A calculator is one of the most convenient and accurate ways to budget and manage your personal finances. The correct calculator can help you track your income and expenses quickly and easily, set financial goals and manage your money more efficiently. It can be an invaluable tool if you're trying to pay off debt, save for a down payment on a house or estimate your retirement expenses. Many different types of calculators can be used to manage your finances, each with unique features and capabilities. Some are simple and easy to use, while others are more complex and offer advanced features like investment tracking and retirement planning. Additionally, many different websites and apps offer personal finance calculators, so finding one that meets your specific needs is essential. When comparing the most popular personal finance calculators, a budget calculator usually tops the list. This type of calculator allows you to track your income and expenses and see where your money is going each month. As a result, you can identify areas where you may be overspending and adjust accordingly. This can help you get a clearer picture of your financial situation and reach your goals sooner rather than later. Understanding budgeting basicsCreating a budget is an essential step in managing your finances. It helps you understand your income and expenses, plan for your future and make adjustments to ensure you reach your financial goals. Budgeting is the process of creating a plan to manage your money, and it involves several steps. Firstly, you need to assess your income and expenses. This involves identifying how much you bring in each month and how much you spend. This step will give you a clear picture of your financial situation and will allow you to identify areas where you can cut expenses or increase income. By keeping track of your income and expenses, you can make informed decisions about managing your money. Secondly, you need to set financial goals. In other words, you must decide what you want to achieve with your money. It could be saving for a down payment on a house, creating an emergency fund, paying off debt or a combination of these goals. Setting financial goals will give you direction and motivation to manage your money more effectively. Finally, you need to monitor your progress toward your goals. By tracking your income and expenses over time, you can compare them to your budget and make adjustments where necessary. This step is essential to ensure that you're on track to reach your financial goals and will help you adjust your budget as your financial situation changes. Types of budgetsWhen it comes to budgeting, there are several different types of budgets to choose from, each with its own unique approach to managing money. Understanding the different types of budgets can help you find the best for your financial situation.

Setting Up a BudgetThis section will cover the steps required to set up and maintain a successful budget over time. Assessing income and expensesCreating a realistic budget requires an understanding of both your income and expenses. This means knowing how much money you bring in each month and how much you're spending. One way to accurately track this information is by using budgeting software or apps. Many options are available, from simple expense-tracking apps to more comprehensive budgeting tools. Another valuable method for tracking expenses is saving receipts and bills, as this can help you see where your money is going and identify areas where you can cut back. Additionally, many online budget calculators can help you calculate your budget, income and expenses. For example, you can find our free online Budget Calculator here. These calculators can give you a clear picture of your financial situation and help you plan for the future. Overall, the key is to track your income and expenses regularly and use the best tools. Creating a budget templateCreating a budget template is an essential step in setting up a budget. A budget template is a tool that helps you allocate your income and expenses in a way that makes sense for your financial situation. There are different types of budget templates available, such as:

It's also essential to include a savings category in your budget template. This is the money you should set aside for your short-term and long-term financial goals, such as saving for an emergency fund, retirement or a vacation. Once you have your budget template, you can use it as a guide for managing your finances. You can track your spending against it and make adjustments as needed. This will help you stay on track and reach your financial goals. Identifying areas for improvementIt's essential to review and adjust your budget regularly. This can help you identify areas where you can cut expenses or increase income. To identify areas for improvement, you can look for areas where you're overspending. If you're spending more than you bring in, it's time to cut expenses. Another way to identify areas for improvement is by looking for areas where you can increase income. Alternatively, you may need to increase income if you're not bringing in enough money to meet your needs. Using a Calculator for BudgetingWhen it comes to budgeting, several different types of calculators are available to assist with your financial calculations. The first type is the basic calculator, a simple calculator that performs basic arithmetic operations. These calculators are great for quick calculations and can be found in most stores. Another type of calculator available for budgeting is the financial calculator. These calculators are specifically designed for financial calculations, such as interest and loan payments. They are more advanced than basic calculators and are often used by financial professionals. Financial calculators can be found online or in stores that sell office supplies. In addition to the above calculators, online budgeting calculators are also available. For example, you can find our free online Budget Calculator here. These calculators can be accessed through websites and often have a more comprehensive range of functionality, such as retirement planning calculators, savings goal calculators and more. They also have the added benefit of being accessible from anywhere with an internet connection. Lastly, budgeting apps can be downloaded on smartphones or tablets. These apps are designed to help with budgeting and personal finance, allowing you to track your spending and create a budget. These apps are great for those who are always on the go and need access to their budget at all times. They can be found in the app store of your mobile device. Tips for choosing the right calculatorWhen choosing a calculator for budgeting purposes, it's essential to consider factors such as the complexity of calculations you're likely to perform and your personal preferences. Firstly, if you're planning to perform complex financial calculations, you'll need a more advanced calculator. However, a standard calculator will do the job if you only need a calculator for basic arithmetic operations. Another essential factor to consider when selecting the right calculator is personal preference. Some people prefer a basic calculator, while others prefer a budgeting app. A budgeting app can be a great option if you're always on the go and need to have access to your budget at all times. However, a financial calculator can be a good choice if you prefer a physical calculator. Choosing a calculator that you feel comfortable using and meets your specific needs is important. Lastly, consider the additional features that a calculator offers. Some calculators come with built-in financial functions, such as the ability to calculate interest and loan payments. In contrast, others provide advanced features, such as the ability to create a budget and track expenses. Consider which features are important to you and look for a calculator that offers them. This will ensure you have the right tools to manage your finances effectively. It's important to choose a calculator that helps you reach your financial goals and makes budgeting easy and effective. Types of budgeting calculationsA calculator can be a valuable tool for budgeting calculations. It can help you determine how much you need to save each month to reach a specific savings goal, create a debt repayment plan or estimate your retirement expenses. Spending plans

Savings goalsWhen calculating savings goals, a calculator can assist you in determining how much you need to save each month to reach a specific savings goal, whether it's for a down payment on a house, a vacation or an emergency fund. This can be done by entering the total savings goal, the time frame to achieve the goal and any interest earned on savings. For example, you can find our free online Savings Goal Calculator here. Debt repaymentCreating a debt repayment plan is another area where a calculator can be very handy. It can help you determine how long it will take to pay off debt and how much you need to pay each month to reach your goal. By entering the total amount of debt, the interest rate and the monthly payment, a calculator can give you a clear picture of how long it will take to pay off your debt and help you create a plan to reach your goal. Using a calculator for personal financeNow that we've looked at budgeting in some detail, let's turn to the wider subject of personal finance. Personal finance is the management of an individual's or a household's money and assets, including income, savings, investments and expenses. It encompasses budgeting, saving, investing, planning for retirement and other financial goals. Personal finance aims to make the most of one's financial resources and achieve financial stability and security. Although personal finance can be a complex and overwhelming subject, the right tools can make it manageable and even enjoyable. One of the most important tools is a calculator, which can help you make sense of your finances by allowing you to perform calculations efficiently and manage your financial progress. We've already looked at the ways calculators can help with budgeting. Now, let's look at the broader role of calculators in personal finance. Investment planningClick here to try our free online Investment Calculators. One of the most important aspects of personal finance is investing your money in a way that will help it grow over time. A calculator can assist you in working out how much to invest, which investment types to make and when to purchase or sell them. For instance, you can use a calculator to calculate your projected return on investment for stocks, bonds, real estate or any other investment vehicles. Furthermore, you can use a calculator to calculate the time it will take for your investment to grow to a particular value at a given interest rate. A calculator can also help you work out returns on investment and evaluate the risk of different investment options. For instance, you can use a calculator to determine the standard deviation of a portfolio of stocks or bonds, a measure of risk. Moreover, you can use a calculator to determine an investment's beta, which measures how volatile the investment is relative to the market as a whole. Additionally, it's crucial to consider factors such as investment diversification and re-balancing, which can help you minimize your risk and optimize your returns. Finance planningClick here to try our free online Finance Calculators.

Additionally, suppose you're considering a mortgage. In that case, a calculator can help you determine the best type of mortgage for you, such as a fixed-rate or adjustable-rate mortgage and the total cost of the mortgage over time. Furthermore, a calculator can also be helpful for leases. For example, a lease calculator can help you determine the total cost of a lease over the lease period, including the price of the vehicle, any down payment, and any other fees. This can help you compare leases to other financing options, such as buying a car or taking out a car loan. Credit cards are another area where a calculator comes in handy. A credit card calculator can help you determine the total cost of carrying a balance on your credit card over time, taking into account interest rates and fees. This can help you understand the actual cost of maintaining a balance and decide how much you can afford to charge on your credit card. It's important to remember to factor in the cost of credit and only take on necessary credit that you can afford to pay back. Tax planningTax planning is a crucial aspect of personal finance as it affects how much money you get to keep. A calculator can assist you in estimating your taxes and planning for tax-saving strategies. For example, you can use a calculator to determine the tax implications of various deductions, credits and exemptions and how they will affect your overall tax bill. This can help you plan your finances and make informed decisions to reduce your tax liability. Furthermore, it can also help you calculate the tax implications of different types of investments, such as stocks, bonds and real estate. For example, you can use a calculator to determine the tax implications of a capital gain or loss on the sale of an investment and how it will affect your tax bill. This can help you make informed investment decisions and plan for tax implications. It's also crucial to consider tax-saving strategies such as 401(k) contributions, HSA contributions and charitable donations to minimize your tax bill. A calculator can also help you determine the tax benefits of these strategies and how they can impact your overall tax liability. By understanding the tax implications of various financial decisions and taking advantage of tax-saving methods, you can effectively manage your finances and keep more money. Inflation planningInflation is a crucial aspect to consider when planning for the future, as it impacts the purchasing power of your money. A calculator can assist you in estimating the effect of inflation on your savings and investments over time. For example, you can use a calculator to determine how much your savings will be worth in the future, given a specific inflation rate and time period. Click here to try our free online Inflation Calculator. Furthermore, you can use a calculator to determine how much you'll need to save to sustain your living standard, factoring in the expected inflation rate. This can help you adjust to your savings and investments to ensure that you're saving enough to meet your future needs. Moreover, you can use a calculator to estimate the impact of inflation on your future retirement income and expenses and adjust your retirement savings accordingly. It's essential to consider the long-term effects of inflation on your finances and factor them into your financial plan. This will help you ensure you have enough savings to maintain your desired standard of living during retirement. Retirement planningOne of many people's most important financial goals is saving for retirement. A calculator can assist you in working out how much you'll need to save for retirement and how to invest your savings to achieve your goals. For example, you can use a calculator to calculate how much you need to save each month to reach a specific retirement savings goal or how much income you'll require in retirement to maintain your current lifestyle. Furthermore, it can help you calculate the amount of income you'll need in retirement and approximate the impact of Social Security and other retirement benefits. For example, you can use a calculator to determine how much of your retirement income will come from Social Security and how much will need to come from other sources such as personal savings and investments. Moreover, you can use a retirement calculator to calculate how much you need to save to maintain your standard of living in retirement and how long your savings will last based on your anticipated return and withdrawal rate. Additionally, it's crucial to consider factors such as inflation and life expectancy when planning for retirement, which a calculator can also help you estimate. Additionally, it's essential to consider factors such as healthcare costs and long-term care expenses when planning for retirement. Examples of calculationsHere are some examples of the types of personal finance calculations where a calculator can be of great help:

These examples clearly show how calculating these results is much easier with a calculator! Ideally, your calculator will have built-in functions to help you with these calculations, however you can also calculate results manually using the relevant formulas. ConclusionIn conclusion, budgeting and managing your personal finances are essential tasks on the path to achieving financial stability and reaching long-term financial goals. Furthermore, a calculator is an indispensable tool in these processes, as it can help you perform a wide range of calculations, from simple arithmetic to more complex financial calculations. By providing more accurate calculations and projections, a calculator can help you understand your current financial situation and take control of your money as you work towards achieving your financial goals. Remember, budgeting and personal finance are ongoing processes that require regular review and adjustments. If you haven't done so already, take the first step today toward building a better financial future. For more information on budgeting and personal finance, many additional resources are available such as financial planning websites, books and online courses. These resources can provide you with more financial information and guidance on these issues. It's also important to remember that calculators are simply tools and the results they provide are only as good as the information you give them. Therefore, it's essential to verify the data you use and consult a financial advisor if you have any doubts or concerns.

|

|

||||

Copyright © Calculator Library, 1998 - 2025. Made with ♥ in Australia. |

|||||

In today's fast-paced world, it's more important than ever to understand your financial situation and create a plan for managing your money. Effective budgeting

and personal finance management are critical skills necessary for achieving financial security and independence. By creating a detailed budget, you can

identify and prioritize your expenses and set financial goals for yourself. In addition, ongoing monitoring of your progress towards these goals is

needed to help you make adjustments where necessary and stay on track to achieving them.

In today's fast-paced world, it's more important than ever to understand your financial situation and create a plan for managing your money. Effective budgeting

and personal finance management are critical skills necessary for achieving financial security and independence. By creating a detailed budget, you can

identify and prioritize your expenses and set financial goals for yourself. In addition, ongoing monitoring of your progress towards these goals is

needed to help you make adjustments where necessary and stay on track to achieving them.

When creating a budget template, it's essential to be realistic and honest about your income and expenses. Start by listing your income sources, such

as your salary, investments and rental income. Then list all your fixed expenses, such as rent, mortgage and insurance. Finally, list your variable expenses,

such as groceries, entertainment and transportation.

When creating a budget template, it's essential to be realistic and honest about your income and expenses. Start by listing your income sources, such

as your salary, investments and rental income. Then list all your fixed expenses, such as rent, mortgage and insurance. Finally, list your variable expenses,

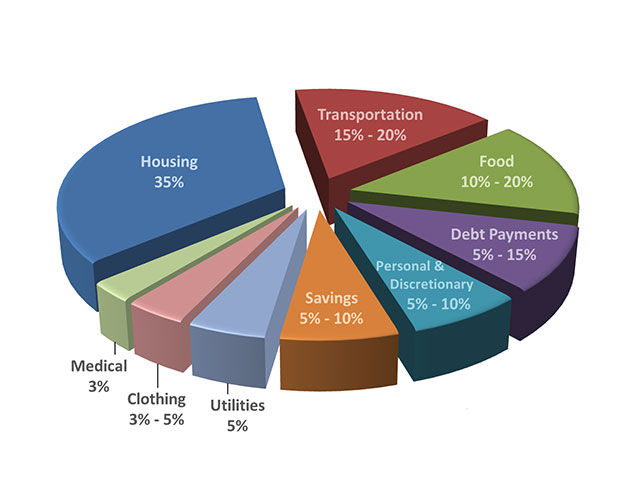

such as groceries, entertainment and transportation. A budget calculator can help you create a spending plan by allocating a set amount of money for specific expenses, such as rent, utilities, groceries and

entertainment.

A budget calculator can help you create a spending plan by allocating a set amount of money for specific expenses, such as rent, utilities, groceries and

entertainment. Another critical aspect of personal finance is managing the various forms of credit and financing available to us. A calculator is an indispensable tool

for determining loan payments, interest rates and amortization schedules. For example, if you're considering taking out a loan for a car or home,

a calculator can help you determine the monthly payments and total interest you'll pay over the life of the loan.

Another critical aspect of personal finance is managing the various forms of credit and financing available to us. A calculator is an indispensable tool

for determining loan payments, interest rates and amortization schedules. For example, if you're considering taking out a loan for a car or home,

a calculator can help you determine the monthly payments and total interest you'll pay over the life of the loan.