|

Calculator Library |

|

|||||

| Home » 87 Calculators » Blog » Financial Calculators | |||||||

FINANCIAL CALCULATORSFinancial calculators are simply advanced calculators designed to help you calculate problems relating to real estate, financial planning, business and economics. Unlike standard calculators, financial calculators can handle advanced functions in areas such as accounting, finance, investment, budgeting and statistics. They can help you calculate rates, conversions, simple and compound interest, cash flow, plan your monthly expenses and ideally make better financial decisions. These additional financial functions mean they have many more keys and use more memory than standard calculators. Here at CalculatorLibrary, we have many specialized financial calculators. Click here to check out the Finance section.

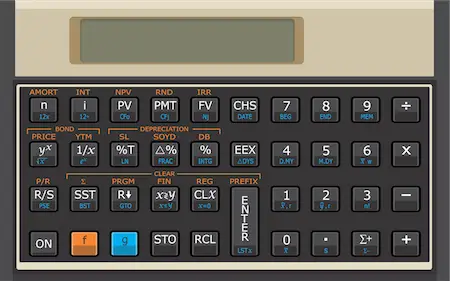

However, we also have a fully functional online version of the famous Hewlett-Packard HP-12C:

Other benefits include the ability to program financial calculators to add specific functions or calculate unique problems and in some cases graph financial calculations. Programming is usually quite a straightforward process, so users without any programming knowledge can usually handle it, and graphing can be useful in economics or when calculating profit margins. Here are some of the main functions for a financial calculator. Basic functions and storageIn addition to all the advanced financial functions, financial calculators can still handle the basic calculator functions such as addition, subtraction, multiplication and division. These calculators have a lot of functions so you'll also see "secondary" or "shift" keys, sometimes color coded, such as f, g or 2nd, that allow multiple functions to be allocated to each key. In this way, each key can have more than one purpose, so you can shift through a range of functions quickly and easily when you need to solve an equation. The first task after turning on a financial calculator is to clear the memory of any other data you've worked on previously. The processes can vary between calculators, but will look similar to the following.

Unlike simpler calculators, financial calculators can store multiple numbers instead of just one or two. Complex equations usually require numbers to be recalled from memory during calculations, so you'll need to store them for future use. For this purpose, financial calculators allocate stored numbers to registers, usually 0-9.

Time value of money calculationsThe "time value of money" is a fundamental concept in economics, meaning that money loses value over time. In other words, every dollar you receive today is worth more than the same dollar received in the future. This concept is very important when considering an investment, loan or planning a budget over time and has a formula to enable calculations: FV = PV x [1 + (i/n)](n x t) To explain the formula, "FV" represents the future value of money, "PV" the present value, "i" the annual interest rate, "n" the number of compounding periods per year (assuming compound interest) and "t" the number of years to be invested. This formula is used by almost every industry involved in finance. Consequently, users need to master it before they move on to other functions of financial calculators. These time value of money functions are unique to financial calculators, using the n, i, PV, PMT and FV keys. In fact, financial calculators were designed with this as a primary function and it's one of the most common calculations you'll use. Although learning the basics of time value of money isn't difficult, you'll need to avoid some of the common mistakes. Time value frequencyA common mistake when dealing with time value of money is entering inconsistent values. To calculate the correct result, the frequencies of n, i and PMT values need to match. Therefore, decide whether the calculation operates on a weekly, monthly or yearly basis and enter your values accordingly. Interest rateMost financial calculators automatically adjust the interest rate depending on the time period you choose. However, you'll need to program the n and PMT values to calculate the correct result. For best results, we recommended setting payments per year to a simple number such as 1, by pressing the 1 key, followed by the f key, then the PMT key. This makes calculations much easier to perform on a yearly basis. Present value of moneyPresent value is one of the simplest calculations you can perform on your financial calculator. It's particularly useful when calculating how much is needed to invest in investments, bonds or any other asset to achieve a certain value at some point in the future. Future value of moneyFuture value is the amount you'll earn from an initial investment over a period of time. This is one of the essential calculations that you or your clients will need to decide which investments may work best over a number of years and what the returns would be. PaymentsWhen calculating payments, you'll need to know how often your interest compounds. This is the first step towards calculating the final payment amount. Yearly values may not always be applicable, particularly when calculating other payment frequencies such as monthly. Ensure you recognize the correct compounding periods, which may not always be the same as other values entered previously. Depreciation calculationsDepreciation is the loss of value of a business asset over time and is another area where financial calculators are a valuable tool. There are a number of different ways of calculating the declining value of those assets, such as the "Straight-Line" or "Declining-Balance" methods, depending on the purpose of the calculation. Calculating depreciation of assets may be necessary for a number of reasons:

A financial calculator will include several keys such as SL (Straight-Line), SOYD (Sum-Of-the-Years-Digits) and DB (Declining-Balance) to help with these calculations. Interest rate calculationsWhen planning any investment, it's very valuable to know how varying interest rates will affect your future results. This is similar to calculating future value, but also allows you to look at "what-if" scenarios, which gives a better perspective of possible risks and results. Calculating interest rates can be extremely beneficial for real estate and financial professionals because it enables you to see the value of an asset over time. Financial calculators can give you all of this information in a few seconds.

If you already know the future value, you can also calculate the period of time required to achieve that result.

|

|

||||||

Copyright © Calculator Library, 1998 - 2026. Made with ♥ in Australia. |

|||||||